Goldman Sachs research seems to point towards DRAM and SSD prices spiking next year as memory supply lags behind demand

It looks like all things memory will increase in price quarter-over-quarter.

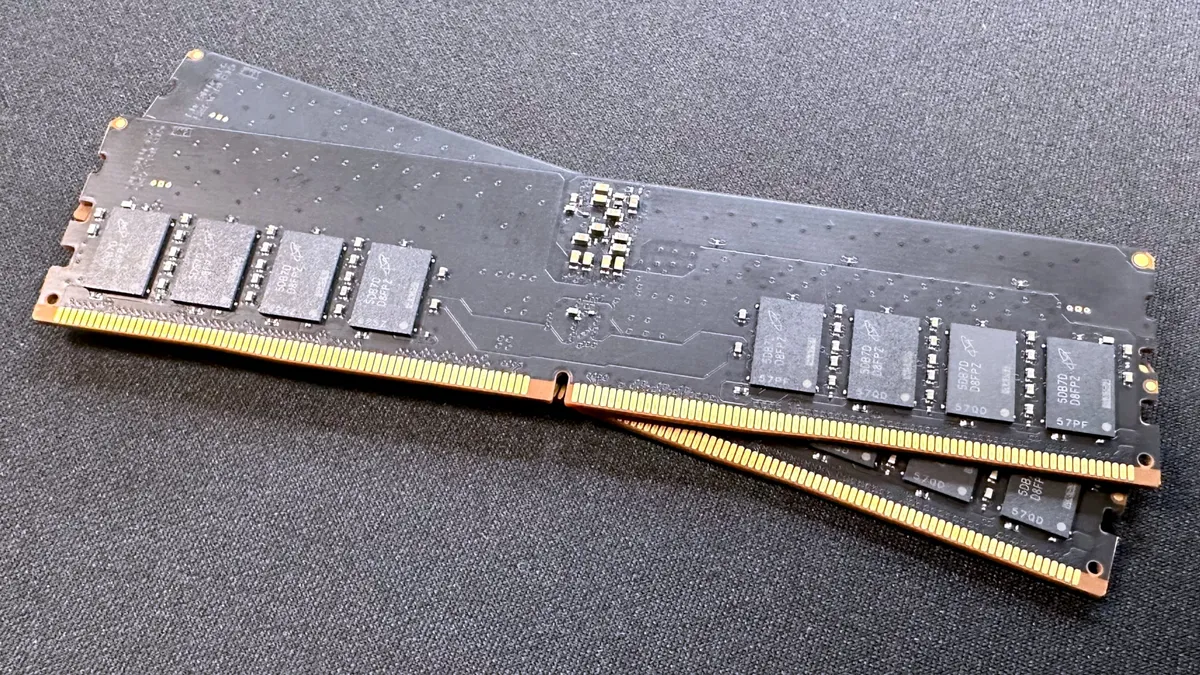

Another day, another reminder that the memory market is screwed, yippee. The storage market as well, actually, although the effects of the HBM and DRAM shortage have certainly been more visible than the effects of the NAND shortage so far. Now, new analyst commentary on Goldman Sachs research predicts—drumroll—a pretty bleak outlook on both memory and storage fronts. Shocker, I know.

Regarding memory, Citrini research analyst Jukan says on X, "demand for both High Bandwidth Memory (HBM) and conventional DRAM continues to outstrip supply."

It looks like something that's expected to be the case throughout the year, too, given "full-year 2026 HBM volume and pricing negotiations for most DRAM suppliers appear to be effectively concluded."

Because of this, and "given current demand levels and persistent supply-demand imbalances, some suppliers see potential for conventional DRAM prices to rise by double-digit percentages (%) quarter-over-quarter (QoQ) throughout every quarter of 2026."

HBM will surely make up the majority of memory production, given that's primarily what's used in all those AI servers that are responsible for this mess.

Jukan also relays that, "At this stage, there appear to be no plans among vendors to convert HBM production lines to conventional DRAM or to repurpose NAND lines for DRAM." Which isn't really a surprise, but just serves as a reminder that the consumer market, including the gaming one, really isn't the priority here. That's not where the big money and the big demand are.

In other words, DRAM prices are expected to go up each quarter because supply will continue to fall behind increasing demand, and this DRAM will feed into HBM.